Signing up is free & takes 5 secs only…

How to spot the Morning Star pattern on Olymp Trade?

Firstly, click the Login to your Olymp Trade account and select the Japanese candlestick pattern from the chart button at the left button of the chart.

It is to be noted that the Morning star candlestick pattern works best with the downtrend. In the Morning star candlestick pattern, the first candle must be a strong bearish candle.

The second candle must have a small body with a small wick indifferent to the colour.

The third candle must be a strong bullish candle with a closing near the mid of the first candle.

How do you trade with the pattern?

Trading with the pattern is very easy.

Let’s check some examples.

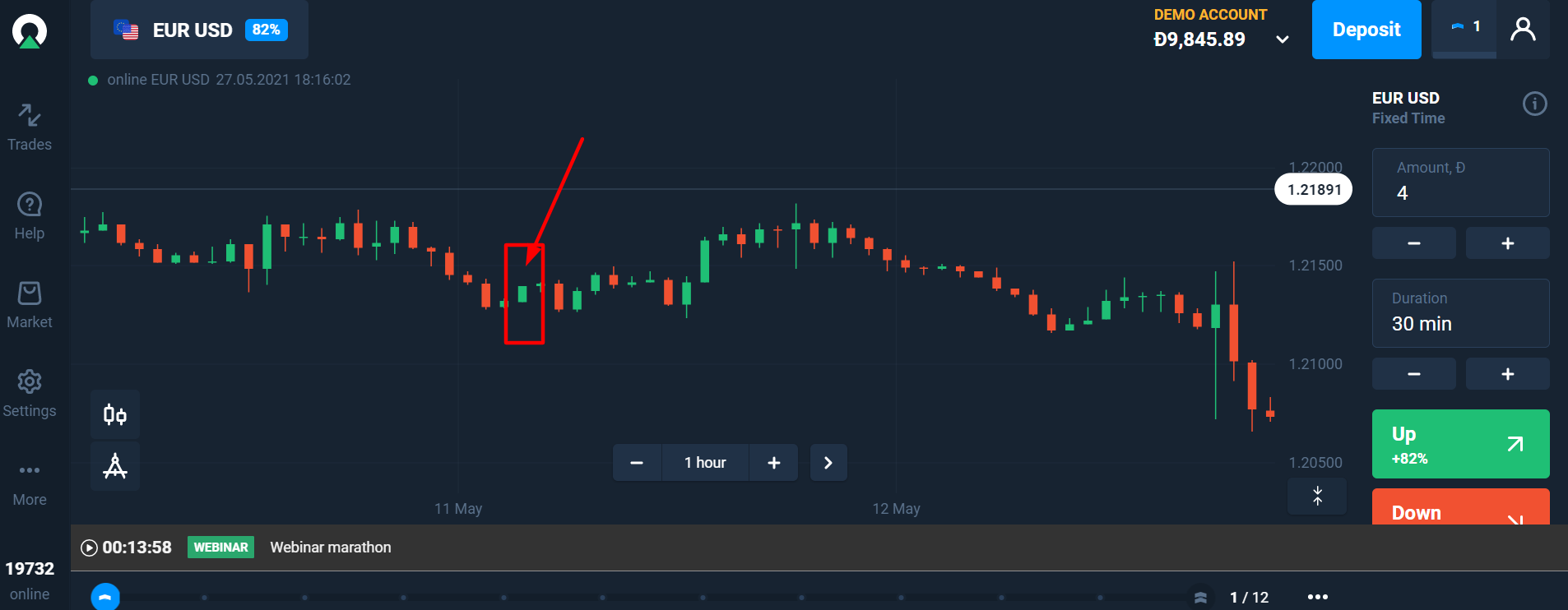

Given above is a 1-hour chart. and we can see a good morning star. (check the arrow)

However, later due to market fluctuations we see a downtrend instead of an uptrend.

Therefore, here we should use support and resistance for confirmation.

See, the chart above, firstly we can see a big downtrend.

Secondly, we see a morning star near the support level.

So, here should go for BUY Trade with a 1-hour time frame. Here, you can take bulk BUY Trade for a big profit.

Read Next: How to win more with evening star candlestick pattern?

Summary

The Morning star pattern is a visual pattern consisting of three candlesticks there are considered bullish in nature by traders.

This candlestick pattern is considered more effective if it appears near the end of a downtrend or close to a support level.

Spotting and trading with morning star are very easy. In this article, I exactly covered the same.

So, this is the end of this article. I hope you found this article really helpful.

However, for the best results use Support and Resistance to confirm your order.

Wishing you the very best of luck 🙂